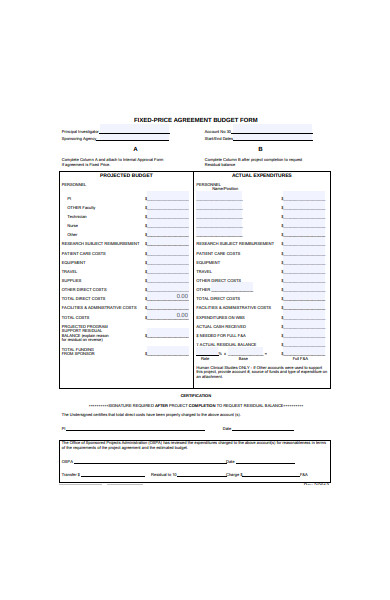

It is a pre-created document with basic formatting that you can use to create your household budget worksheet as per your needs. This household budget worksheet enables individuals to pay their bills on time without depending on loans or credit cards. Since having a budget and sticking to it helps individuals develop excellent financial habits, it is necessary to have a household budget worksheet. It is all about setting up the program to fit the person’s needs which is time-saving compared to starting from the beginning, like using paper and pen. Some spreadsheet programs usually have an in-built template that can calculate an individual’s household budget. An individual can set up such a program on their computer and use it to make the documenting process easier. Spreadsheet programĪnother way of documenting how an individual spends their finances can be done by using a spreadsheet program. In addition, it does not require someone to have expert knowledge when they document their spending. This process might be tiresome but is simple and affordable. This can be adequately done using any of the following ways: Use paper and penĪn individual can use paper and pen to document their spending. Sometimes, indirect costs can be waived directly.Different Ways of Documenting your Spendingīefore you prepare a household budget worksheet, the first and most important thing to do is to document your earnings, spending and outline your budget. Some foundations (Mellon) prohibit the charging of indirects, while some institutions offer different indirect cost rates depending on the grant activity, so MAKE SURE you investigate and get the lowest rate possible. Indirects are charged at a federally negotiated rate, typically calculated as 50-60% of your direct costs (varying by institution), and at different rates for different activities (e.g, teaching vs. Indirects are used to pay for all the things that aren’t directly related to your project, but are required by your project (lighting, heating, printer paper, wireless access/network connectivity, administrative overheads). This includes publishing fees for project-related articles (e.g., journals that require a fee for article publication).ĭon’t forget about server hosting fees, small equipment purchases (can only be used for the project), publicity swag, and consultant fees or honoraria. This category generally covers miscellaneous expenses, including printing agendas, name tags, etc. Do differentiate between domestic and foreign travel, and again, justify costs with vendor quotes.

If you are presenting (or applying to present), include that in your proposed budget. Funds can be used to meet with collaborators at other universities, and it’s generally acceptable to travel to conferences so long as it is connected to your project.Provide vendor quotes in your justification or as supporting materials.Be aware that purchase of some types of equipment will be prohibited or intensely scrutinized (e.g., laptops, phones, tablets).Equipment can only be used for work specifically described in your proposal, so if the item will be useful beyond the life of the project, mention it as a part of building a “sustainable infrastructure.”.You should generally only include large equipment needs (over $5,000 for single item).If you need to make an adjustment, you may be able to do a re-budget, which is generally fine if you’re moving money around within categories, but generally frowned upon if you attempt to move money from one category to another.Do not include time spent developing the budget in the budget.Do not forget to include your project manager, programmer, and systems administrator in your staff!

In deciding between research assistants or hourly student workers, consider that research assistants are better for projects that require a sustained engagement or intellectual role, while hourly students workers are generally better for specific, short-term tasks. Attend to the difference among faculty, staff, and student pay scales and schedules.Ensure that you place people in the correct salary categories, and do not forget to include benefits.Base calculations on your actual salary.Salaries (typically the largest portion of a budget): Consider asking for guidance from your university grants office, if possible.Use templates where possible: they reduce both error and workload.Double-check the funder’s specific requirements and limitations.

You do not want is to get midway through a project only to discover you do not have the funding to complete your proposed objectives and deliverables. In addition, don’t forget to consider long-term or recurring costs as well as immediate funding needs. Both are equally important, but they may have different requirements. Before creating the budget, consider to whom you will be submitting it: an external funder or an internal funder.

0 kommentar(er)

0 kommentar(er)